Capital Asset Pricing Model explained!

The capital asset Pricing Model (CAPM) is developed by an American economist

William F. Sharpe, he published this model in his book Portfolio Theory and Capital Markets

According to him, there are two types of risk in the investing

Systematic Risk

Unsystematic Risk

Unsystematic Risk or diversifiable risk is something that is inherited risk and affects a certain company or even an entire sector. Let's imagine you buy stocks of a company A for Rs.100000. and later some time due to some reasons like the management didn't perform well, the company was overvalued and the stock price reduced drastically, such reasons might affect your investment, not the and that's unsystematic risk i.e, specific to a company.

you can reduce unsystematic risk by diversification and asset allocation.

Systematic Risk or non-diversifiable risk is something that affects the overall market, stocks form all sectors get affected and the systematic risk can't be diversified or avoided. Factors such as inflation, interest rate, geopolitics, and monetary policies of the central bank are the cause of systematic risk. Let's assume that you own a well-diversified portfolio of 20 stocks, a recession will affect all the 20 stocks and the overall stock market, another example is the financial crisis of 2008. so, the systematic risk can't really be diversified, unlike unsystematic risk.

Now, CAPM is a way to measure the systematic risk. It shows the relationship between the rate of return and the risk of owning the security(market risk). Basically, it shows the risk and return of the security, and based on your risk tolerance, you can buy the security

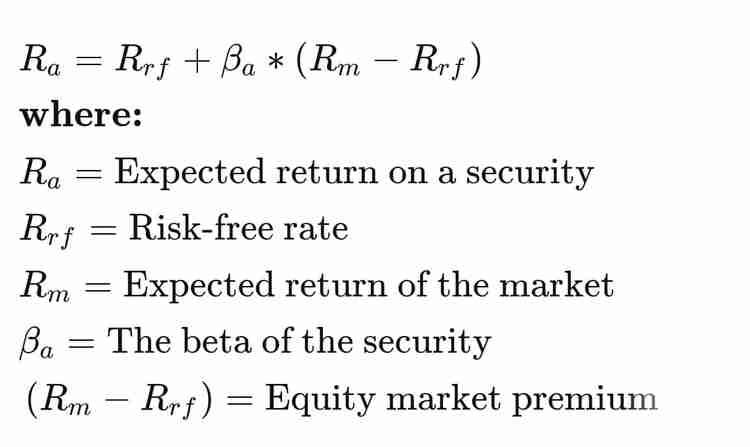

Here is the formula for CAPM

The formula is pretty simple to understand, we will explain it!

Beta(βa)

is the measure of the volatility of a stock or a portfolio, compared to the overall stock market. Beta basically tells us how much the stock will be affected when there is a bear market or when the stock market is volatile and vice versa. For example, if the beta of a stock is 1, then the stock is said to be volatile and there will be a huge change in stock price when the stock market is volatile(i.e more UPs and DOWNs) and if the beta of stock less than 1, then the stock is considered to be less volatile i.e there will be less change in stock price when compared to the stock market and during high market volatility

here is how you can calculate beta

Risk-free rate

The risk-freerate is the return on investment that investors get for investment with no risk.

all securities have some risk with them and a risk-free rate is just a theoretical number. rate of return of government bonds is taken as the risk-free rate because the government is less likely to default on bonds and government bonds are considered as the least riskier securities.

Expected Return of the Market is the average return of the stock market or the security.